United Nations has published the Intergovernmental Panel on Climate Change (IPCC) 6th assessment report on climate mitigation, including many strategies to fight climate change and reach net zero. UN's key takeaways call on urgent action to cut GHG emissions in the next ten years to save the planet from deepening the already catastrophic environmental crisis we're dealing with. The world needs to join these efforts, with the financial sector playing an essential role.

In essence, the powerful industry should figure out how to use the money to create solutions to the immense carbon footprint humans are leaving.

The new report from IPCC also includes a severe warning to CEOs and leaders across the globe; if they don't start making changes right now, we could reach the dreaded 1.5 threshold in 2030. There will be significant changes throughout all sectors to avoid that horrific scenario.

After looking into the main reasons we're dealing with such a severe climate crisis and the consequences of global warming, IPCC's experts published climate mitigation options. To slow down the process we all fear, it's critical to cut down the massive amount of GHG emissions by 2030.

The deadline for 1.5 threshold

is dangerously close

The latest report on climate mitigation is the third of the three essential write-ups on the groundbreaking new policies, innovations, and technology needed to make the drastic change. In addition, IPCC explained how the mitigation should look between sectors and how to connect and trade-off to adaptation.

There is little time to implement and jumpstart these climate solutions, which means the decision-makers have a close deadline to adopt those measures. However, when it comes to the fintech sector, there are several key IPCC conclusions executives should know about.

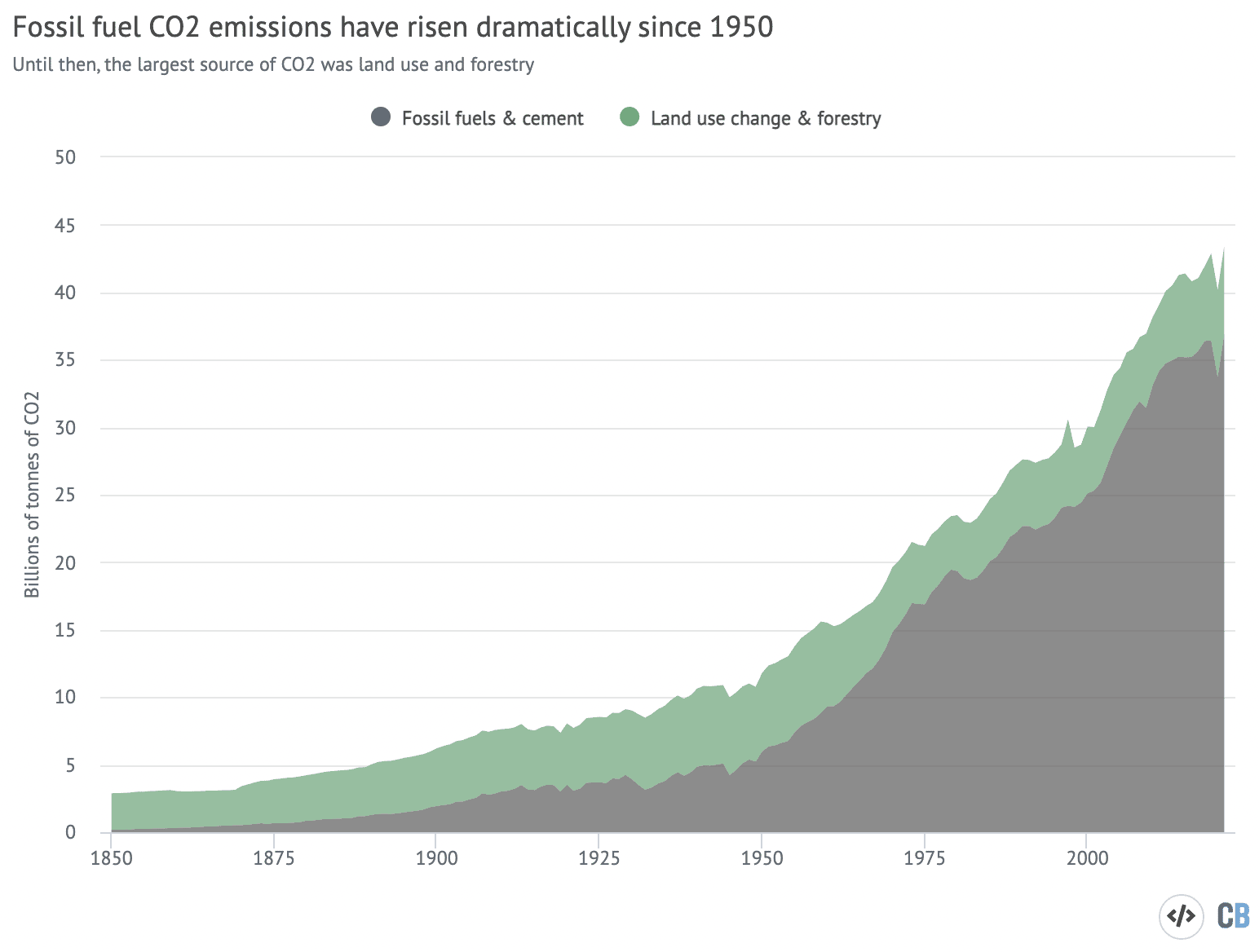

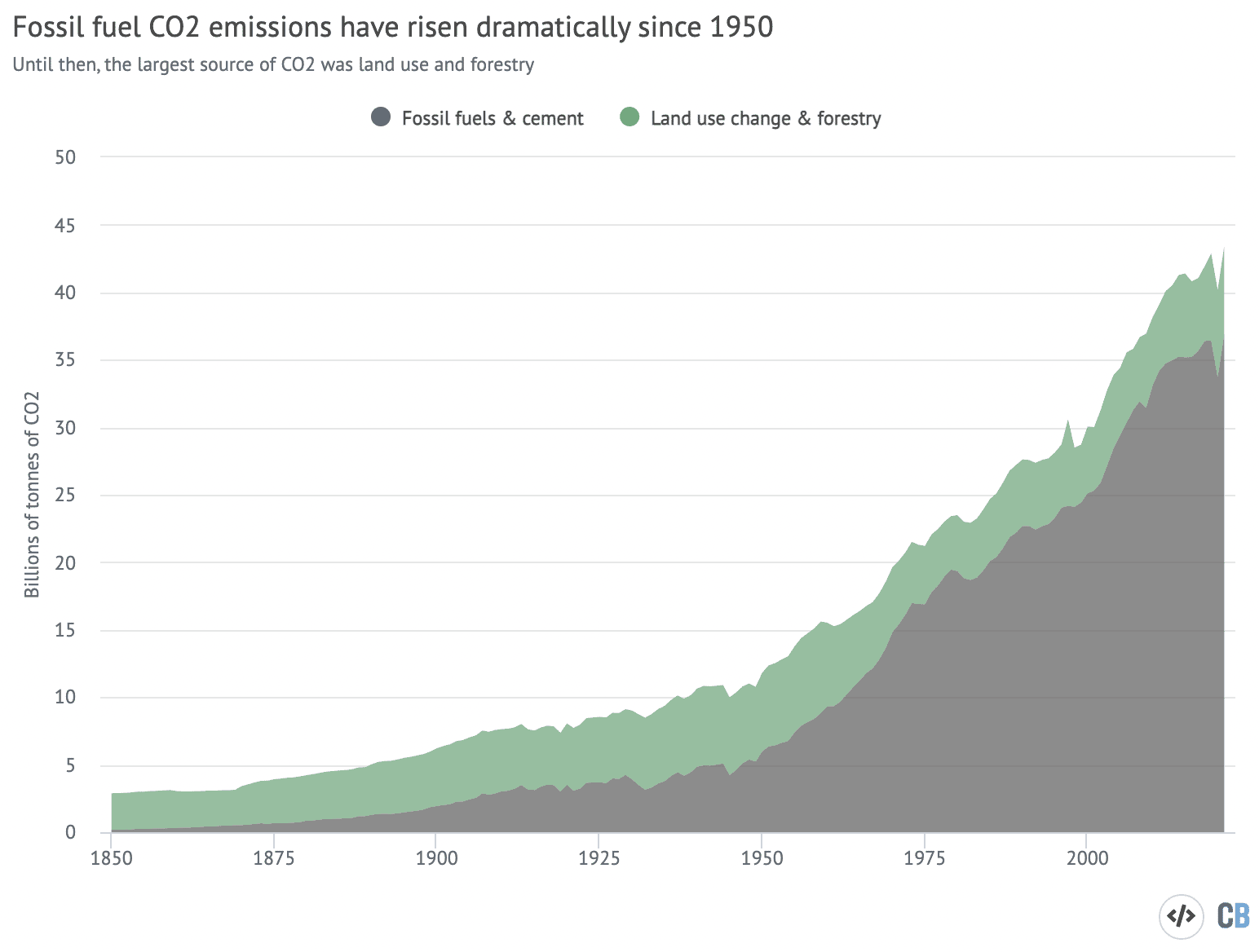

Fossil fuels are the first to blame for the massive amounts of greenhouse gases (GHG) heating and suffocating the planet. In fact, since the industrial revolution, humankind has released 2.500 gigatonnes of carbon. Numbers steadily grew during that time, with the 2010-2019 decade being the worst.

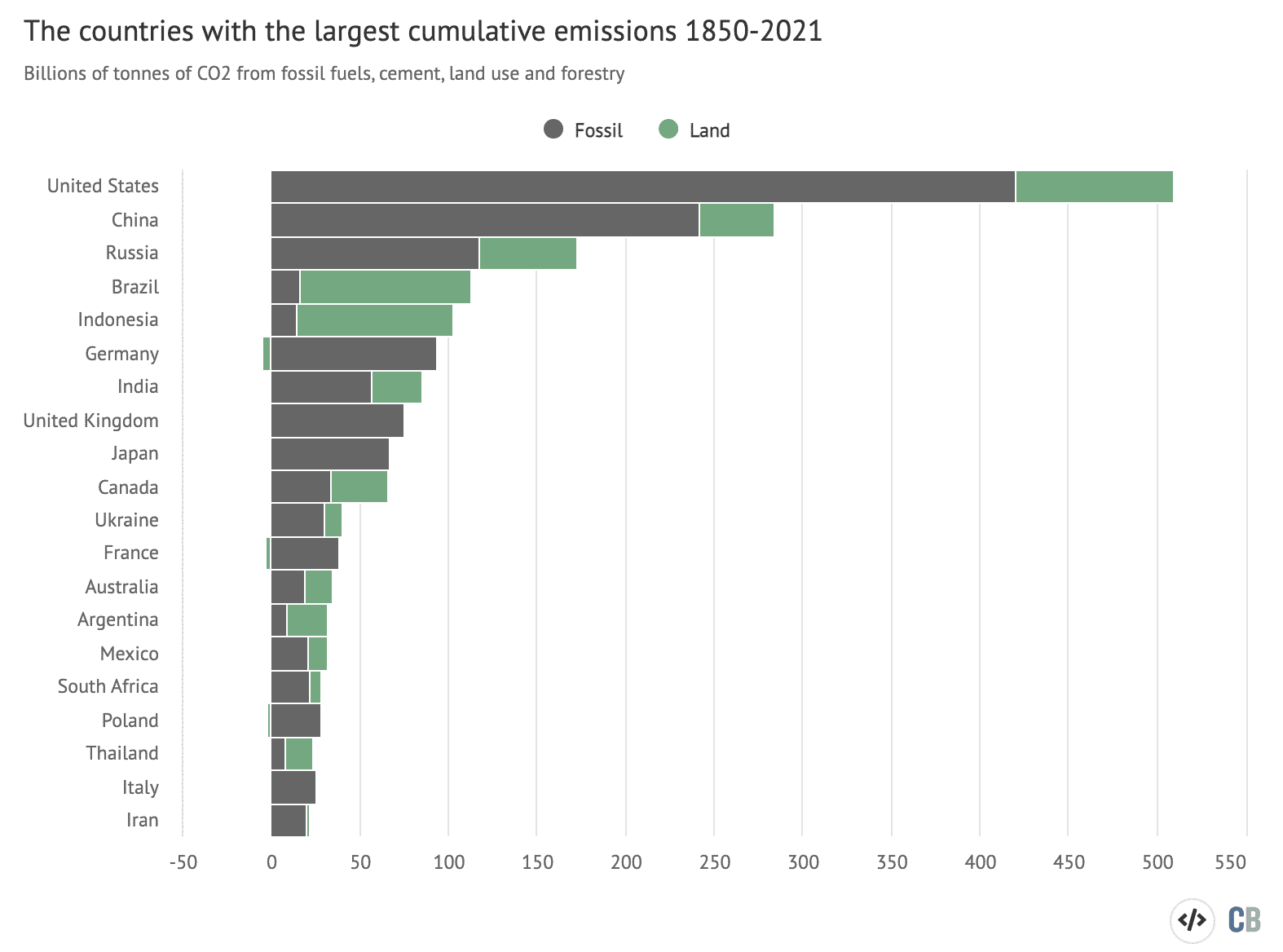

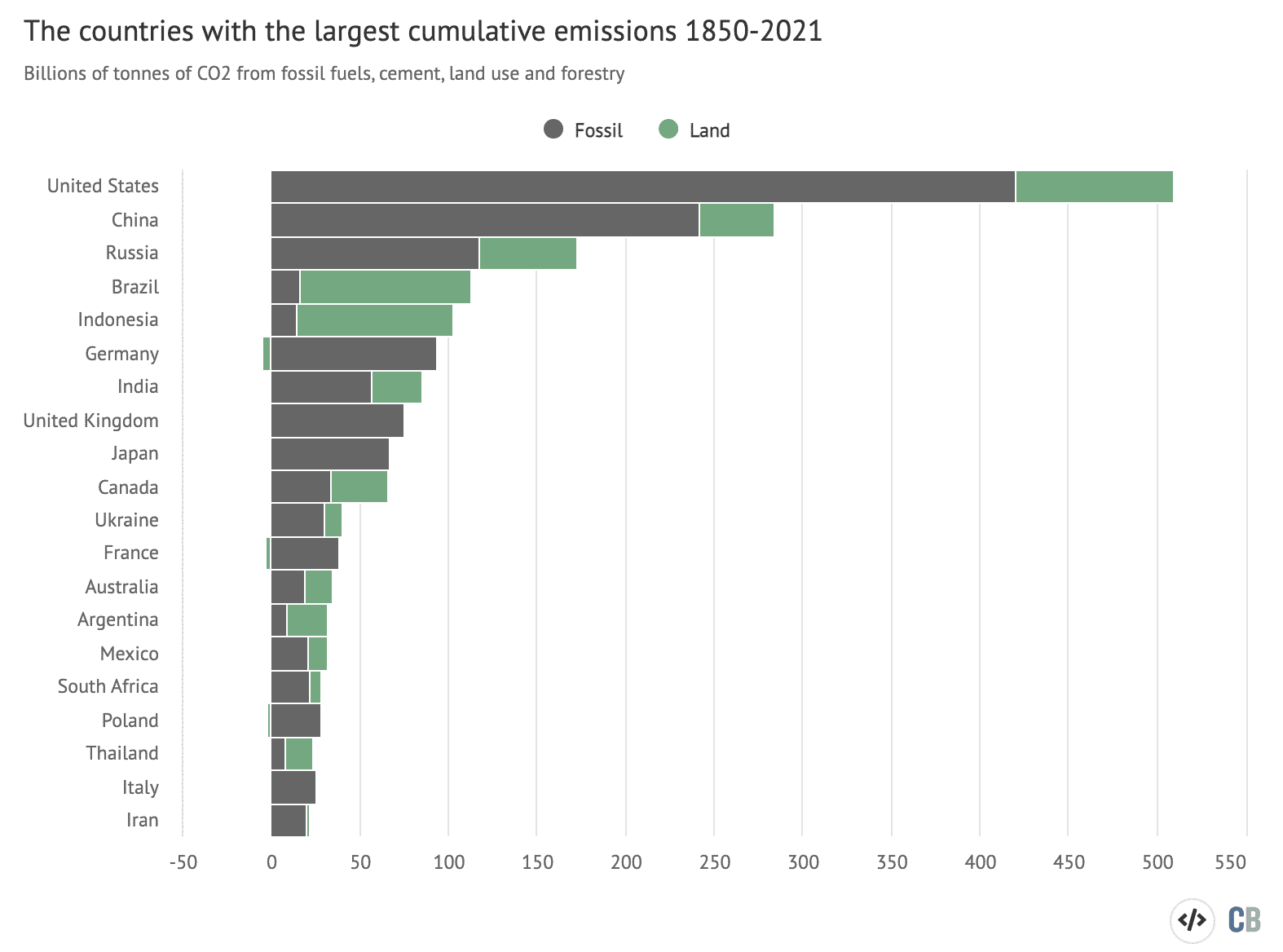

Emissions from hundreds of years ago still contribute to our massive carbon footprint

This brief shows another alarming fact; the CO2 emissions from hundreds of years ago still contribute to global warming. In fact, the current situation is determined by the cumulative total of GHG emissions. The latter also represents a basis for calculating the carbon budget, the maximum emissions we can emit to stay below the threshold of global warming temperatures.

Although there are now groundbreaking policies and initiatives such as renewable energy, carbon offsetting, and net-zero stocks, there is much more to do to cap our carbon footprint to planet-safe levels.

IPCC states that reducing fossil fuel combustion is a positive and commendable effort throughout the industrial sector. However, climate mitigation will have to pass through all industries, from transport to construction and agriculture.

Critical IPCC report takeaways

Luckily, the experts at IPCC claim that at least now we know our critical issues and steps to overcome them. However, these challenges will require a joint effort on all ecosystem levels.

According to the IPCC report, financial institutions need to include key climate mitigation measures when dealing with their investment portfolios.

1. Put a stop to all new fossil projects

The industry sector should refrain from adding new fossil projects; it should immediately stop with those already on plan. If not, we could easily overstep the 1.5 thresholds. Instead, the sector should invest in renewable energy to cap its carbon footprint.

2. Lower the industry, transport, and construction demands

IPCC suggests climate mitigation by saving energy and material, implementing innovative technologies, and urban building planning. We will have to start the shift to electric cars and public transport and lower our consumer demands overall.

3. The AFOLU sector must implement climate mitigation many measures

Forestry, agriculture, and land-use sector can cap their carbon footprint with reforestation, pausing deforestation, plant-based diets, and fewer fertilizers. Also, composting, food waste reduction and other measures could lead to massive GHG reductions.

But, more importantly, the AFOLU sector should use the enormous stores of manageable carbon resting underground.

In line with the aforementioned measures, the financial sector is expected to join efforts to fight extreme poverty. The latter means learning and implementing new skills and some drastic changes, with equality as IPCC's focus.

4. The IPCC's 6th report serves as a climate mitigation measures guideline for the financial sector

It's simple; when deciding on their new investments and opportunities, financial institutions should focus on the economies and companies following the path to net-zero.

To make it easier for the sector, the IPCC has underlined three critical measures to minimize the horrific effects of climate change.

5. Governments must implement rigorous climate policies

This includes carbon prices supporting the net-zero goal. Importantly, decision-makers should consult science and decide on must-abide policies and thresholds. For example, focus on the climate mitigation initiatives in the scope of low-carbon. That means implementing net-zero regulations and setting a positive example to employees and society overall for financial institutions.

6. Follow the Science-Based Target Initiative (SBTi) recommendations

In addition to coal phase-out, which is the most carbon-intensive fuel, financial institutions should also track and measure the carbon footprint of their investments and carbon activities. In doing that, they should follow the PCAF standards.

Additionally, they should show they align with the newest IPCC report and consult frameworks such as SBTi's financial sector guidance, states the 6th IPCC report.

As can be seen above, there is lots to do and little time to do it. Hence the dire need for the most meaningful joint effort until now, on all fronts and throughout all sectors. Of course, decision-makers and leaders bear most of the responsibility, but climate mitigation rests on the entire globe's effort.

The crucial next few years

"The next few years will be crucial for the state of climate change in this century. This is why an updated assessment of mitigation is more important than ever. The Working Group III report will shed light on solutions to meet this challenge by providing us with the latest scientific findings of mitigation of climate change", said the Chair of the IPCC, Hoesung Lee.