Share capital

The authorized capital of the DGB Group amounts to €750,000.00 and is divided into 18,750,000 ordinary shares, 18,749,900 preference shares, and 100 priority shares, each with a nominal value of €0.02.

- The issued capital is 11,400,349 ordinary shares and 100 priority shares.

- 4,052,175 of the ordinary shares are listed on Euronext (ISIN: NL0009169515).

- Per 1 January 2024, DGB holds 203,946 shares in treasury.

Convertible notes

DGB has issued convertible loan notes amounting to €97.872 in total on the following terms:

- DGB has issued convertible loan notes for the amount of €97.872. The conversion price is €0.40. The loan notes may convert early at the discretion of the noteholder. The loan note holders have the right to request a redemption in cash on 1 April 2024 if no conversion has been requested before then. The loan notes bear no interest rate.

Share options

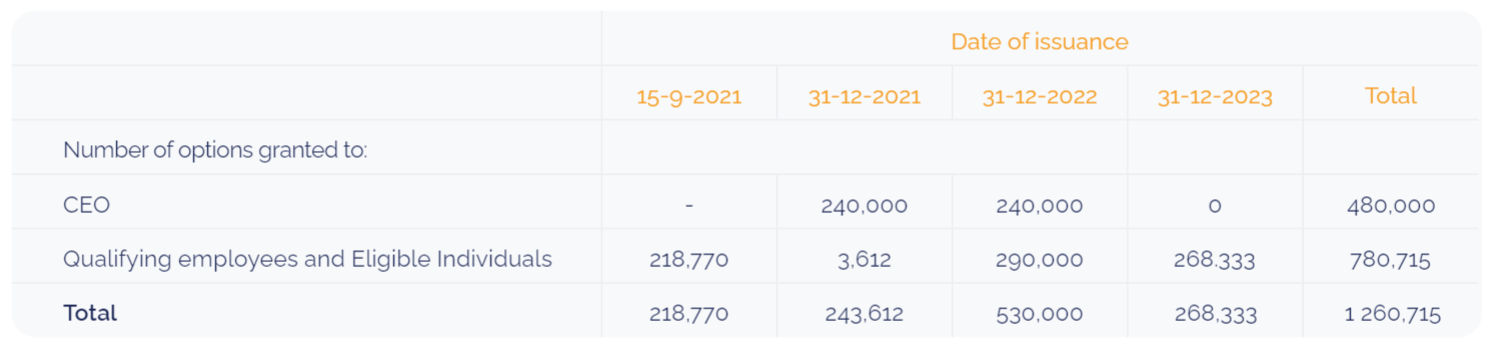

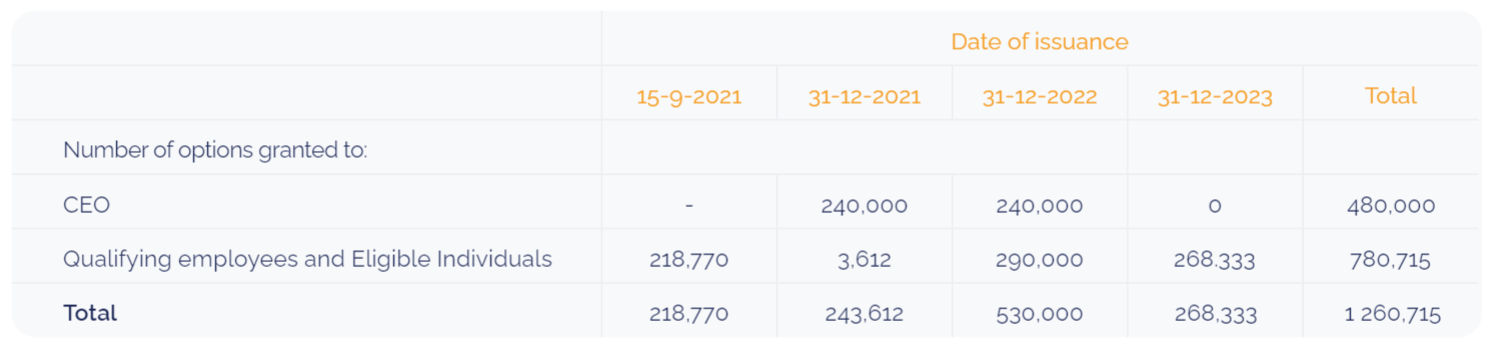

On 15 September 2021, the Group established share option programmes (link) that entitle qualifying employees and Eligible Individuals to purchase shares in DGB. Under these programmes, holders of vested options are entitled to purchase shares at the market price of the shares at the grant date. The key terms and conditions related to the grants under these programmes are as follows; all options are to be settled by the physical delivery of shares.

Per 1 January 2024, there are the total options outstanding:

The vesting period for the granted share options is 2 years after the grant date. After vesting, the share options must be exercised within 3 years.

Dividend policy

The dividend payment depends on the financial results and the equity of DGB Group. In the event of disappointing results or investments, it is possible not to distribute a dividend for that year. If a loss has been incurred in any year, no dividend will be paid for that year. In a dividend proposal, various factors will be taken into accounts, such as the financial and operating result, the capital position, legislation and regulations, and whether the available resources are required for repayment or investments.

The Board of Directors makes a proposal which, with the approval of the non-executive director, determines which part of the profit will be added to the reserves. This is done after the payment of dividends on the preference shares (no preference shares have yet been issued). Thereafter, the General Meeting of Shareholders, on the proposal of the Board of Directors, can resolve to distribute the part of the profit that remains after addition to the reserves as a dividend on the ordinary shares. Payment will be made after the adoption of the annual accounts showing that distribution is permitted.